Introduction

Looking ahead to Pakistan's centenary in 2047, this is an opportunity to draw lessons from its past and focus on its long-term development opportunities. Pakistan has made significant progress since its creation. However, recurring boom-bust cycles, decelerating growth, and problems with the sustainability and inclusiveness of growth have limited the country’s potential. In the past, a broad range of promising reforms were designed to tackle Pakistan’s development challenges, but the track record of implementing difficult reforms has been mixed and attention often had to focus on seemingly more imminent crises. As 2018 comes to a close, the cycle seems to be repeating itself, with a new administration having to focus efforts on avoiding a macroeconomic crisis instead of the business of longer-term development.

The origins of the frequent macroeconomic crises in Pakistan are structural in nature, not cyclical, and require an appropriate policy response. There are a number of reasons for Pakistan’s macroeconomic crisis in 2018: low revenue collection combined with rigid expenditures and an institutional set-up that has made the adoption of prudent fiscal policies challenging; an uncompetitive economy that has resulted in a steady decline of Pakistan’s share of exports in world markets; and governance structures that have facilitated poor economic policies. While several steps to restore and maintain macroeconomic stability are urgently needed, sustaining stability and avoiding recurring boom-bust cycles will also require focusing on medium-term structural reforms. This means that Pakistan does not have the luxury of focusing solely on short-term macroeconomic stability, as ignoring the crucial medium-term reforms would only pave the way for the next macroeconomic crisis.

This report aims to move the focus beyond short-term challenges and onto Pakistan’s long-term development. This involves recalling what the challenges to long-term growth are, which reforms are suitable to overcome them and—most crucially—understanding why such reforms have often not been implemented successfully in the past. The aim of Pakistan@100 is to contribute to a citizen-centric discussion on the reforms and the political environment needed to address structural shortcomings. This means that Pakistan@100 is more than just a report, including close engagements with local researchers and citizens, continuous engagement with various stakeholders and knowledge exchange with many parts of Pakistan’s society. This overview report acts as a reference document to continue the discussion on Pakistan’s future and contribute to a conducive reform environment.

The upside potential from a structural reform agenda is significant: Pakistan has the potential to increase its per capita income almost fivefold and achieve upper middle-income status by its centenary in 2047. Pakistan is gifted with a young and growing labor force, significant amounts of arable land, and geographic proximity to some of the largest and fastest growing economies on the planet. Leveraging this potential while substantially curbing population growth would allow Pakistan to accelerate and sustain growth to achieve upper middle-income status when it turns 100 years old in 2047. This would raise annual per capita income almost fivefold and lift millions of people out of poverty.

However, moving toward upper middle-income status requires a deep-rooted economic transformation. The economic transformation necessary to achieve upper middle-income status entails a boost to capital investment and significant improvements to the health and education of all Pakistanis. Moving toward an upper middle-income future also encompasses structural transformation that moves people from farms and low-value added services to highly productive, innovative and well-managed firms. Conversely, if the current status quo continues, namely that growth remains at current levels and population growth does not slow, in 30 years Pakistan will have income levels very close to what they are today, and yet another generation will have missed the opportunity to benefit from Pakistan’s potential.

How Has Pakistan Grown in the Past?

After a period of rapid economic progress in its early years, political instability, dwindling foreign inflows and a deteriorating security situation have slowed the rate of growth in Pakistan since the 1990s. In the first 20 years after independence in 1947, Pakistan had the highest growth rate in South Asia. But the nationalization of all major manufacturing industries and banking by Z.A. Bhutto in the 1970s caused a significant growth slowdown and loss of investor confidence. Bhutto’s successor, M. Zia-ul-Haq, abandoned the process of nationalization in the 1980s but did little to reverse the damage done in the previous decade. Nonetheless, the economy performed better in this period partly as a result of increased foreign assistance. However, by the 1990s Pakistan had become the slowest growing country in the region (Figure 1), as growth suffered under political instability, a deteriorating security situation and reduced foreign assistance, all exacerbated by the imposition of sanctions following the country’s nuclear tests in 1998 (Husain, 2010). In the 2000s, Pakistan was once again under a military regime and the increase in foreign aid due to Pakistan’s participation in the war against terror helped boost economic growth. But the worsening security situation and growing political instability in the late 2000s once again led to the slowing down of growth in the country. The complex security situation, particulary over the past 40 years, as well as widespread rent-seeking behavior have undermined the state's strength to implement reforms.

Pakistan has a history of slow growth and repeating boom-bust cycles. As noted above, Pakistan has seen repeated boom-bust cycles, most frequently coinciding with periods of abundant foreign assistance or its withdrawal. Episodes of high growth were never sustained and always reversed within a few years (Figure 2). In recent years, growth has slowed further and dropped from an average of 6.1 percent per year throughout the 1980s to 4.1 percent on average since 2011. Pakistan’s relatively slow and volatile growth, coupled with population growth rates of 2.4 percent over the past 20 years, implies that per capita growth rates have been below 2 percent on average since 2010.

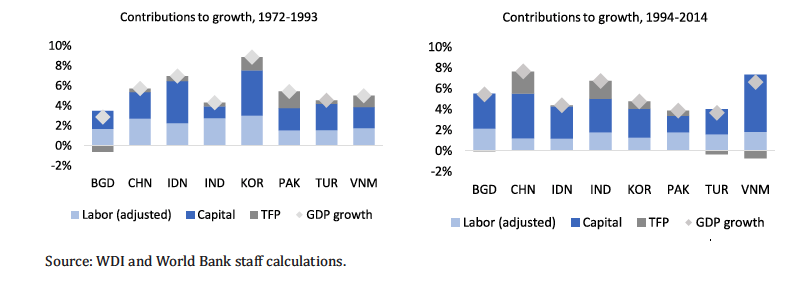

Evidence shows that the slow accumulation of physical capital and slow total factor productivity (TFP) growth have held back economic growth in recent years. Pakistan’s TFP growth fell by one-third between the 1980s and the 2000s, leading to a decline in labor productivity, from a growth rate of 4.0 percent in the 1980s to 0.8 percent in the 2000s. Among its regional peers, Pakistani labor is the least productive and this gap has increased over the past two decades (Figure 3). The contribution of capital accumulation to growth has decreased over time. This deceleration is the result of a steady decline in investment (as a ratio of GDP) from an average of 20 percent in the 1980s to about 15 percent since 2011. Accelerating Pakistan’s growth will require increased investment in both physical and human capital, while maintaining the country’s stock of natural capital, such as clean air and natural resources, and an improvement in productivity.

What Are the Drivers of a Growth Transformation?

Putting Pakistan on a path to upper middle-income status requires significant increases in investment and productivity growth. To better understand the magnitude of the changes necessary for Pakistan to move toward upper middle-income status, a dynamic growth framework (Hevia and Loayza, 2011) is used to simulate how reforms that improve factor accumulation and TFP affect growth. Simulation results drawn from the framework suggest that Pakistan can gradually accelerate growth and reach upper middle-income status by its centenary under three key assumptions: First, this can be achieved if Pakistan were to gradually increase investment from 15 to 25 percent of GDP. An investment rate of 25 percent is still below the regional average, with India, Bangladesh and Sri Lanka all investing above 25 percent of GDP. Second, accelerating growth requires enhancing TFP growth from 1 to 2 percent per year. Third, achieving upper middle-income status requires a gradual deceleration of population growth rates, from currently above 2 percent to 0.9 percent by 2045, consistent with population growth rates in other South Asian countries that currently lie around 1.1 percent. The assumed gradual deceleration in population growth is broadly consistent with projections used by the United Nations and other researchers (Population Council, 2013; UNFPA, 2016) (see the Pakistan@100 policy note ‘Growth and Investment’ for further details). These assumptions suggest a challenging, but not impossible, pathway toward the target of upper middle-income status (Figure 4).

Box I: Description of the dynamic growth framework

The necessary preconditions for Pakistan to gradually accelerate growth and reach upper middle-income status by 2047 are derived from a dynamic growth framework developed by Hevia and Loayza (2011). The framework assumes that growth is driven by a combination of three factors: i. Accumulation of Physical Capital: Investment, as the driver of physical capital accumulation, is financed through savings or foreign capital inflows. The model assumes a constant foreign debt-to-GDP ratio and a solvency condition that requires that the net present value of foreign liabilities can be financed by net exports. These conditions pin down a sustainable value of the current account deficit that, together with savings, determines investment. ii. Increases in the Stock of Effective Labor: Effective labor is determined by the size of the labor force and the years of schooling that the labor force received. iii. Total Factor Productivity Growth: TFP growth is exogenous to the model and represents factors such as technological progress that enhances the efficiency with which the effective stock of labor and the physical capital stock are used. Combining these three drivers of growth allows the model to simulate a set of long-run growth outcomes based on the evolution of three factors: investment as a function of the savings rate, the foreign debt-to-GDP ratio and capital rates, productivity and workforce growth, as well as increases in educational attainment.

Accelerating and sustaining growth over a 30-year period is ambitious, particularly given Pakistan’s most recent track record. But it is possible: other countries have achieved similar economic transformations. TThe suggested increase in income levels within a generation is an ambitious goal that will be challenging to attain. However, other countries have experienced similar income increases. Figure 4 shows the Rep. of Korea’s growth acceleration between 1960 and 1990, from an income level comparable to Pakistan’s today to upper middle-income status in just over 20 years. Similarly, Figure 4 also shows that China managed the transition from low-income to upper middle-income status in just 11 years, starting from a per capita income in 1981 that was less than half of Pakistan’s today and increasing income about 14-fold by 2011. Other countries have followed similar paths, including Malaysia, which in 1960 had income levels comparable to Pakistan today and has increased GDP per capita more than threefold subsequently. Initial conditions (growth and investment rates, education levels, and population growth) in all of these countries were similar to Pakistan’s today. Even if the growth transformation that Pakistan is able to generate falls short of the experience of these high achievers, reforms that accelerate and sustain growth over a long period of time, avoiding the frequent boom-and-bust cycles, will significantly improve the lives of millions of Pakistanis and put the country on a different development trajectory.